Goodbye Customer Lifetime Value

Payback Velocity Is Your New Core Metric

3 min. read

By Edwin HENGSTMENGEL

PARTNER, ENDEIT CAPITAL

Edwin is a Partner at Endeit Capital – a growth capital firm with offices in Amsterdam, Hamburg and Stockholm.

He is a board member at Floryn and an investor in Bux, but these days increasingly working on Climate Technology, Educational Technology and B2B Software. He served as director of the LOEY Foundation, a Dutch initiative to stimulate Entrepreneurship.

Perspectives by Atscale

Insights from

tech executives and investors

for tech leaders in H2, 2023

The Hague School is a collective term for a group of painters active in The Hague between around 1860 and 1890. I have a painting at home but no clue about its value. Maybe not important as I am not planning to sell. Even though you might not be selling your business anytime soon, you are consciously aware that SaaS businesses are generally valued on a multiple of their revenue. In most cases, the projected revenue for the next 12 months (“NTM”).

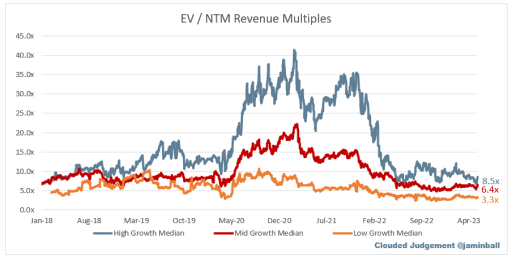

Economist Alfred Rappaport educated me early in my career and explained that revenue multiples are a shorthand valuation framework. Given that most software companies are not profitable, or at least not generating meaningful Free Cash Flow (FCF), it is, however, the only metric to compare the entire industry against. The promise of SaaS is that growth in the early years leads to profits in the mature years. SaaS multiples are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue. Jamin Ball – check out his Clouded Judgement newsletter – considers high growth (>30% projected NTM growth), mid-growth (15%-30%), and low growth (<15%). The median has come down considerably over the last 18 months:

8.5x

High Growth Median

6.4x

Mid Growth Median

3.3x

Low Growth Median

With valuations plummeting – unless you are an AI or Climate tech startup – you can be assured that unsophisticated investors are washed out of the market and no longer active. Luckily, you never wanted an unsophisticated investor on your cap table anyway. Investors still active in the market are spending more time and conducting longer due diligence to better understand cohorts and unit economics for new investment possibilities. Overall, it’s not a bad situation since the DD outcomes can help you set post-financing priorities, such as through a 100-day plan, for example. However, in my humble opinion, many investors have made their DD somewhat of a laborious and nagging process. I don’t believe that final investment decisions should mostly result from answering tons of questions around Contribution Margins, Customer Lifetime Values, Customer Acquisition costs, etc.

Bill Gurley, the general partner at Benchmark, once explained that the Utopian destination imagined by the Customer Lifetime Value (LTV) formula is a mirage. Hear, hear!

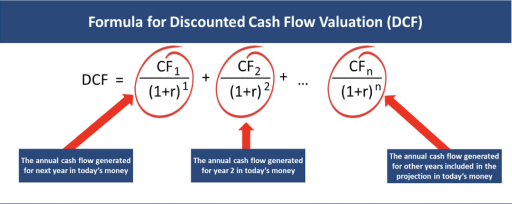

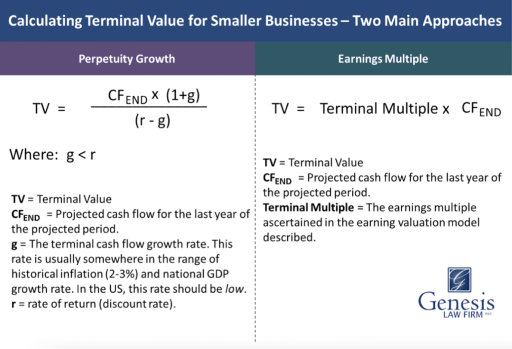

A Utopian destination outlined in Excel formulas almost never works out as planned in the long run. Either growth begins to slow, or you run out of capital to continue funding losses. Enter 2023, when the Venture Capital industry cries uncle and asks to see profitability. Late(r)-stage multiples have declined significantly, and we are painfully reminded that the long-term value of a company is still based on discounted future cash flows. Current valuations are simply a reversion to the mean. With rising interest rates, we all understand that the denominator (the discount factor) is rising. Money is no longer free, and cash flows (the numerator) start to matter.

See the source article “Cash Flow Valuation: Part 4 of How to Value a Small Business” ².

When all this happens, and investors start asking for a clear path to profitability, the fragility of the LTV model also starts to appear. Customer Acquisition Cost (CAC) is often a little higher than expected. You met your growth target, but the projected loss was bigger than expected. Venture Capitalists are hounding you for churn numbers, but you are reluctant to give them out.

The lack of transparency then leads to cynicism, and everyone assumes the worst. It turns out that the excessive marketing spend was also propping up repeat purchases, and pulling back to achieve profitability is increasing churn. Moreover, a negative cycle has ensued because of your upcoming valuation decline and investors’ new doubts about the sustainability of your model. Not only are results impacted, but so has customer perception of your brand.

The bottom line is that the notion of “one day we can stop spending and be remarkably profitable” rarely comes to fruition.

It’s not impossible to create permanent equity value with the LTV approach, but it’s a dangerous game of timing – you don’t want to be the peak investor, and Endeit Capital certainly does not want to be. Let’s say a new business starts with aggressive marketing techniques and aggressive fundraising. The company can achieve amazing revenue growth (and corresponding losses) but nonetheless creates a rather sizable organization. Eventually, however, gravity

ensues. For early founders and investors, they may do okay but it will be accomplished on the backs of later-stage investors that helped fund the unsustainable push. This has been the story of many scale-ups over the past years, often in capital-intense market segments such as mobility.

David Peterson, partner at Angular Ventures, wrote about his lessons as an early employee of Airtable, where he was responsible for growth. David always thought of his job as optimizing a funnel. You acquire users, you activate users, and you get those users to pay. And ideally for more than you paid to acquire them in the first place.

“The bottom line is that the notion of “one day we can stop spending and be remarkably profitable” rarely comes to fruition.”

But he learned growth should not be thought of as a funnel. Growth, done well, is all about loops. The easiest ones to identify are the product growth loops. A user signs up, activates on your product, does something that helps acquire a new user (for example, inviting a colleague or sharing a piece of content), and then the new user starts the loop all over again. Product growth loops are so powerful because they are specific to your product (and thus can’t be copied) and are compounding (with each new user driving additional user acquisition).

But paid marketing loops are just as powerful. In 2017, David noticed the growth team at Monday.com had started experimenting with an “early bird” discount. Here’s how it worked: one day after you signed up for an account, they’d offer you a 33% discount on an annual plan if you upgraded immediately.

If you, like most paid marketing teams, were just myopically focused on reducing your CAC, increasing your ARPU (average revenue per user), or optimizing the ratio of your LTV to CAC, you might have missed the genius of this tactic, because offering such a hefty discount would decrease your ARPU and would thus move your LTV/CAC ratio in the wrong direction.

“Growth should not be thought of as a funnel. Growth, done well, is all about loops.”

This is exactly why you need to think in terms of loops. If product growth loops are about leveraging users to get more users, then paid marketing loops are about leveraging revenue to get more users. And that’s precisely what this “early bird” discount was all about. By significantly decreasing the time it took for paid marketing dollars to get paid back as revenue, Monday.com was supercharging its marketing team, enabling them to reinvest much more quickly.

To put a finer point on it, while every other marketing team out there was getting seduced by lifetime value³ to justify their burgeoning budgets, Monday.com was recycling dollars into an ever-growing marketing monster.

This thinking is especially important when cash is hard to come by. Hello, 2023! Optimizing for a payback period might not make sense when you can just go back to investors and raise more capital whenever you’d like. But what if this is the last €1m you’ll ever be able to spend on marketing? Suddenly, payback velocity matters a whole lot. The quicker that €1m hits your bank account again, the quicker you can reinvest, and the quicker you can grow your customer base and drive more revenue... to reinvest again (it’s a loop, after all).

I found this to be a great piece of advice: throw out your lifetime value model and refocus on payback velocity. It made sense back in 2017 when Monday.com did it. And it makes even more sense today.

“If product growth loops are about leveraging users to get more users, then paid marketing loops are about leveraging revenue to get more users.”

² “Cash Flow Valuation: Part 4 of How to Value a Small Business” by Genesis Law Firm: genesislawfirm.com/cash-flow-valuation

³ “The Dangerous Seduction of the Lifetime Value (LTV) Formula” by Bill Gurley, published on Above The Crowd: abovethecrowd.com

Perspectives by Atscale

DIGITAL RELEASE

Discover a curated collection of content from

and for leading tech investors and executives

for H2 2023.

We hope that Perspectives

will be your trusted

and reliable guide

for H2

This paper is not commercialized.

Distribution channels in Q3:

HARD COPY

ATSCALE SELECTED NETWORK

(500 executives)

For a hard copy, feel free to connect with us directly

DIGITAL COPY

WAITLIST REGISTRANTS

AUTHORS’ NETWORK

EVENT PARTICIPANTS